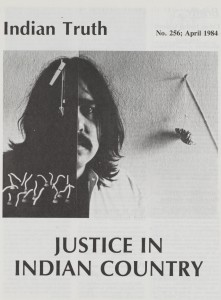

Indian Rights Associations

The Women’s National Indian Association and the Indian Rights Association, both founded in Philadelphia in the late nineteenth century, led the way in setting a national agenda concerning the plight of Native Americans. They continued a local tradition of reform movements promoting rights and ...